Today’s Path to Success Might Become Tomorrow’s Route to Ruin

Author: Ladeja Godina Košir, Founder and Executive Director of Circular Change, Co-Chair of the European Circular Economy Stakeholder Platform in Brussels, and Member of the Working Group of Chapter Zero Slovenia

The World Economic Forum has developed a set of eight principles to guide the development of effective climate governance. To make these principles useful and tangible, each of them is accompanied by a set of guiding questions. These questions help organisations to identify and address potential gaps in their existing climate governance strategies.

As Chapter Zero Slovenia is committed to ensuring that its board members pursue climate governance, we have produced a series of monthly articles explaining the eight climate governance principles, which are designed to increase their climate awareness, embed climate considerations into board structures and processes and improve navigation of the risks and opportunities that climate change poses to business.

"... leaders in companies save money over time, reduce risk, innovate more, build valuable corporate reputation and brand strength, attract and retain talent and achieve greater employee engagement."

Source: Paul Polman & Andrew Winston: Net Positive – How courageous companies thrive by fiving more than the take, Harvard Business Review Press, 2021

Doing business in a time of polycrisis, when risks are intensifying and compounding, requires adaptation and leadership that gives more to the environment and society than it takes from it, argue Paul Polman, former Unilever CEO, and Andrew Winsdon, sustainability guru. In the long run, such business delivers positive results not only for shareholders, but for all stakeholders.

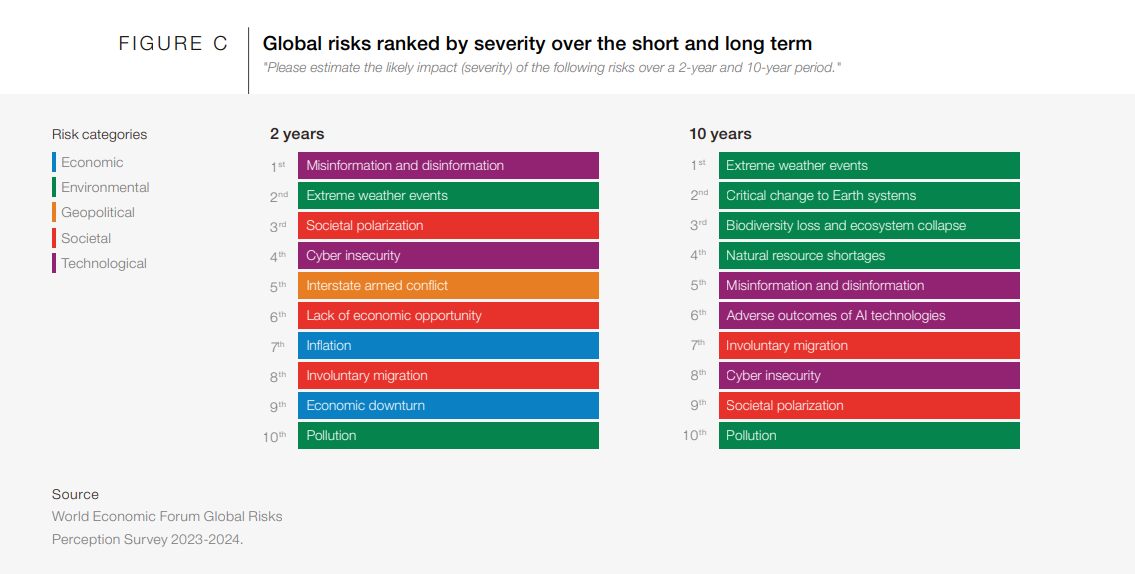

Among the global risks that are key for the next ten years, the WCEF 2024 report identifies half of the ten risks as climate change-related. What does this mean for business? Failure to integrate climate considerations into companies' strategic and organisational frameworks cannot ensure long-term resilience and competitiveness. Focusing exclusively on factors that can deliver positive business results in the short term is likely to jeopardise a company's viability in the medium and long term.

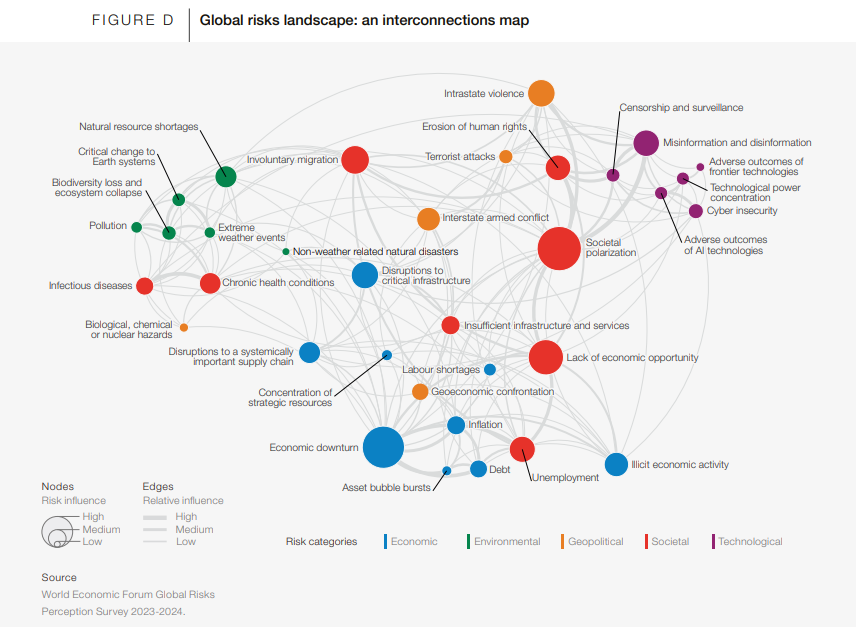

To ensure that risks are properly considered and managed, climate risks and opportunities need to be strategically integrated into the core business strategy. Boards need to consider the impact of climate change on long-term value creation and integrate corporate sustainability objectives into their business. Understanding the interconnectedness and interdependence of different factors is crucial in this regard. Climate factors are closely linked to geopolitical, economic, social and technological factors. To illustrate with a concrete example - extreme weather conditions threaten people's health, disrupt daily activities, damage important infrastructure, causing gaps in the value chain, weakening the market position of a company, halting production due to a lack of key resources, etc.

To integrate climate considerations effectively, board members should:

- Align climate strategy with corporate vision: Make sure the company's climate goals are aligned with its mission and long-term strategy.

- Consider science-based targets: Set measurable climate targets, such as reducing greenhouse gas emissions. Targets should be ambitious but achievable and should be regularly reviewed and adjusted when necessary.

- Integrate climate risks into corporate risk management: Integrate climate risk assessment into the overall corporate risk management framework. This includes assessing the financial implications of climate risks and ensuring that these risks are taken into account in strategic planning and investment decisions.

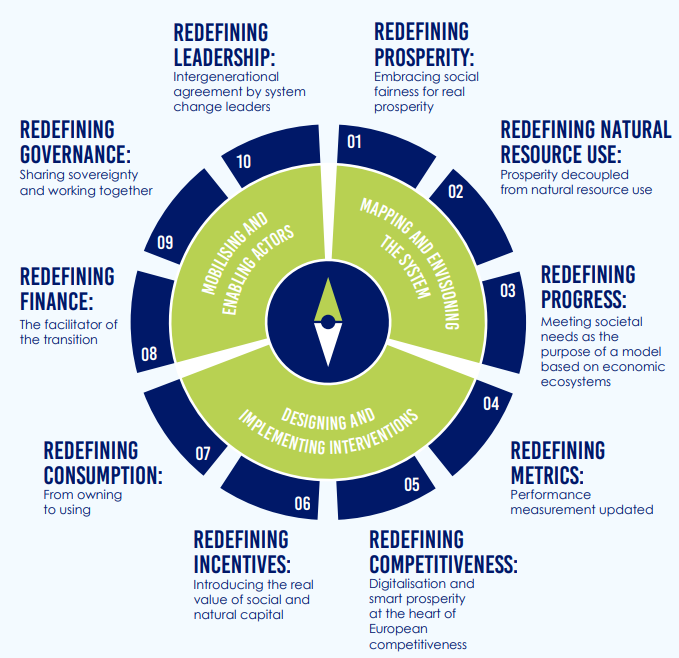

In addition to strategic integration, organisational integration is also important. The latter focuses on integrating climate governance into the organisational structure and culture of the company. The interdependence and interconnectedness of the various factors mentioned above dictates a systemic approach. A demanding adaptation process is needed for a company to be able to carry out a comprehensive and effective transformation that will deliver the desired results. Key concepts need to be reviewed and redefined - from, for example, what constitutes progress, to measures of success, finance and, ultimately, leadership. The System Change Compass is an excellent tool to guide decision-makers and other stakeholders through the overall transformation process.

Key actions for organisational integration include:

- Enhancing board competencies: Ensure the necessary expertise on climate issues - either by recruiting directors with specific skills or by providing education and training to existing board members on climate risks and opportunities.

- Assign clear roles and responsibilities: Assign clear responsibilities for climate governance within the organisation. Designate leadership to drive the climate strategy and ensure that climate objectives are mainstreamed across all organisational units.

- Improve disclosures and reporting: Ensure transparency by introducing good practices - reporting in line with the Task Force on Climate-related Financial Disclosures (TCFD). Enable investors and stakeholders to have access to clear and consistent information on how you manage climate risks.

- Foster a culture of sustainability: Create a corporate culture that values sustainability and encourages innovation in response to climate challenges. Involve employees at all levels in the company's climate strategy.

Issues that arise behind closed doors of the boards

Until recently, environmental issues were considered irrelevant to business. They were removed from priority lists, not included in key performance indicators, and had a place in the appendix to annual reports dedicated to sustainability reporting. Today, the situation is reversed - with increasing (including regulatory) pressure on boards to see climate change as an increasingly important risk factor that needs to be properly addressed, the following questions or concerns arise - based on experience in Slovenia and abroad:

- Short-term financial pressures - how to balance short-term financial targets with long-term sustainability goals. Climate action is still seen by some as a cost that can affect short-term profitability and share prices, which is at odds with investor demands for immediate results.

- Unstable regulatory environment - unclear and unstable regulatory environment makes strategic planning difficult, new legislation brings unexpected costs or requirements that are difficult to meet.

- Lack of expertise - climate change is a complicated and complex subject. Many board members do not have the necessary expertise or support within the company and feel under pressure because they feel unable to adequately assess the risks and opportunities associated with climate change.

- Organisational change and mindset change - implementing climate action often requires major organisational change, which can be met with resistance within the company. There are differing views and tensions among employees, changes are not welcomed, and there is a lot of scepticism about the benefits of the proposed changes.

- Reputation and fear of greenwashing - on the one hand, climate change presents an opportunity to make changes that contribute to improving corporate image, but at the same time there is a risk that sustainability activities will be labelled as ineffective or even "greenwashing", thus undermining the company's reputation.

These and related concerns and issues often go unspoken, as board members are reluctant to show uncertainty or weakness, especially on issues as complex and strategically important as climate change. This is why Chapter Zero, through the Climate Governance Principles, is paving the way for new knowledge, experience and, above all, for open dialogue among decision-makers.